straight life policy formula

Determine the cost of the asset. Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life.

Written Down Value Method Of Depreciation Calculation

Dont lapse or cancel.

. Up to 100000 in coverage. With the life expectancy of retirees continuing to lengthen having a guaranteed life. 4800 3 years.

See your rate and apply now. No cost or obligation. Other common methods used to calculate depreciation.

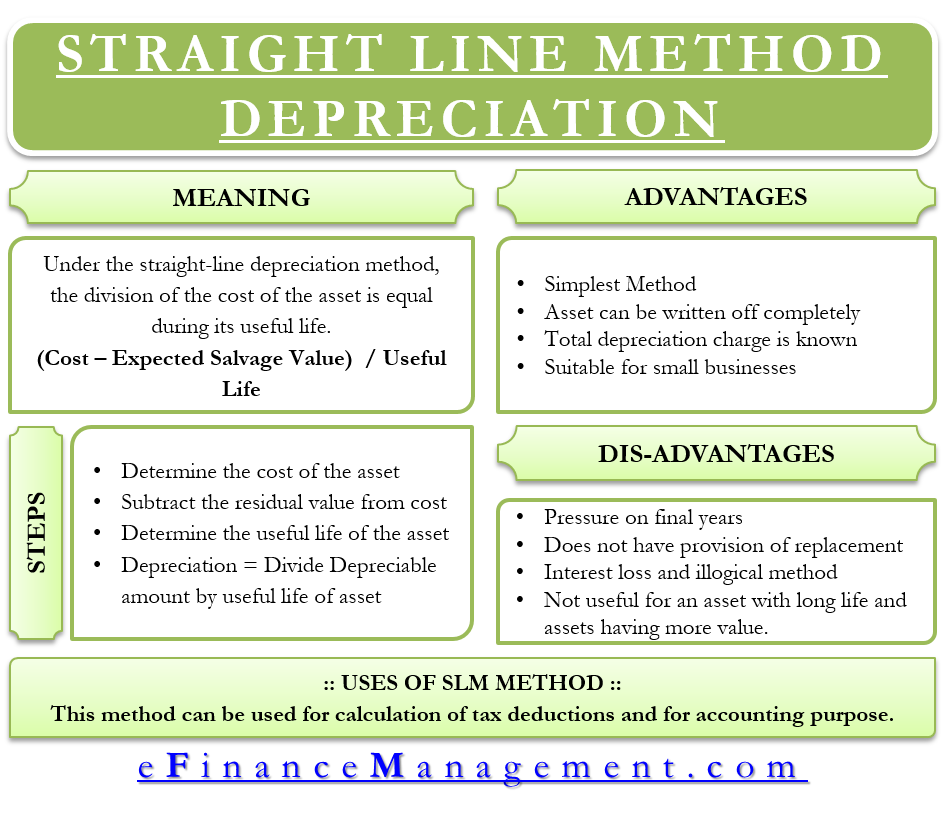

Straight life insurance is a type of whole life insurance. Rate of depreciation can be calculated as follows. This method is most commonly applied to intangible.

A whole life policy in which premiums are payable as long as the insured lives. Depreciation expense for the year ended 31. Like other forms of whole life insurance the death benefit of a straight life policy is guaranteed to remain in place for life.

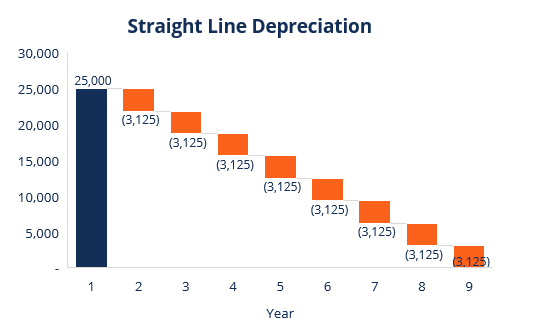

Second year depreciation 2 x 15 x 900 360. Using this information you can calculate the straight line depreciation cost. Rate of depreciation is the percentage of useful life that is consumed in a single accounting period.

The straight life option pays a monthly annuity directly to the retiree for life. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Ad See if you qualify to sell your policy for cash.

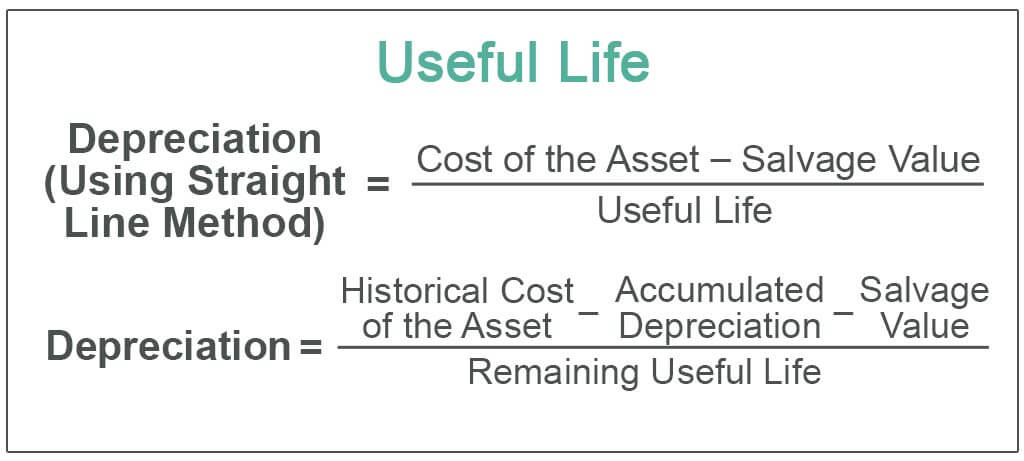

Depreciation is calculated based on the fiscal years remaining. Ad See if you qualify to sell your policy for cash. So in the second year your monthly depreciation falls to 30.

The term straight refers to the whole life insurance policys premium structure. An insurance product that makes periodic payments to the annuitant until his or her death at which point the payments stop completely. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

Suppose a business has bought a machine for 10000. Straight life is the simplest benefit option offered by APERS. Rates starting at 11 a month.

It is also known as ordinary life insurance. Goldwyn The Urban Institute September. Joint and Survivor Pension Payout Options.

Uccello and Joshua H. How Do Married Retirees Choose. Updated Oct 15 2021.

The goal of a permanent policy is to have life insurance in place for the rest of your life. Ad Over 12 Million Families Trust SelectQuote To Find Their Life Insurance Policy. Also known as whole life insurance a.

According to straight-line depreciation this is how much depreciation you have to subtract from the value of. Straight Life Annuity. A straight life insurance policy can also build cash value over time.

Estimated assets value at the end of useful life. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. Dont lapse or cancel.

The depreciable amount of the vehicle is 15000 20000 cost minus 5000 residual value and useful life is 4 years. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used. International Risk Management Institute Inc.

Annual depreciation purchase price - salvage value useful life. No cost or obligation. Straight line amortization is a method for charging the cost of an intangible asset to expense at a consistent rate over time.

5000 purchase price - 200 approximate salvage value 4800. Get an instant estimate. You can calculate subsequent years in the same way with.

Get an instant estimate. Straight Line Formula Example 4 A radio service panel truck. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the.

Depreciation Expense Cost Salvage ValueUseful life. A straight line basis is a method of computing depreciation and amortization by dividing the difference between an assets cost and its expected salvage. Rate of depreciation.

What is Straight life. The straight life annuity choice gives the retiree an income he cannot outlive. The straight line basis is a method used to determine an assets rate of reduction in value over its useful lifespan.

On the death of the retiree the monthly payments. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable. Ad Exclusive term life insurance from New York Life.

After death however the payments cease and the. 02 x 15 3. Purchase price and other costs that are necessary to bring assets to be ready to use.

They have estimated the useful life of the machine to be 8 years with a salvage value. Straight Line Basis. What is a Straight Life Policy.

For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. Straight Line Depreciation Method Examples. Straight life insurance is a type of permanent life insurance.

The straight line calculation steps are.

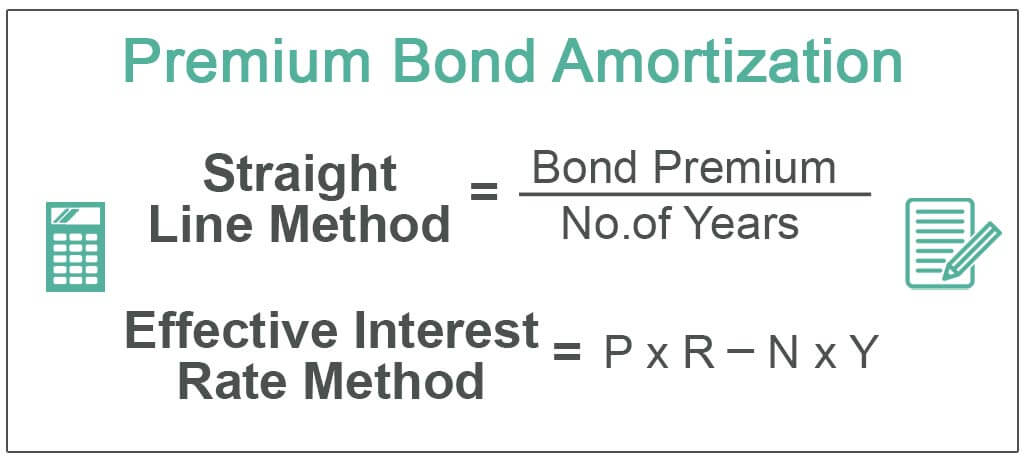

Straight Line Bond Amortization Double Entry Bookkeeping

Amortization Of Bond Premium Step By Step Calculation With Examples

Depreciation Methods 4 Types Of Depreciation You Must Know

Straight Line Depreciation Efinancemanagement

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Fixed Assets Double Entry Bookkeeping

Net Book Value Meaning Formula Calculate Net Book Value

Straight Line Depreciation Formula Guide To Calculate Depreciation

Useful Life Definition Examples What Is Asset S Useful Life

Straight Line Depreciation Formula Guide To Calculate Depreciation

Straight Line Depreciation Template Download Free Excel Template

Depreciation Formula Calculate Depreciation Expense

Loss Ratio Formula Calculator Example With Excel Template

Prime Cost Straight Line And Diminishing Value Methods Australian Taxation Office

Depreciation Methods 4 Types Of Depreciation You Must Know

Salvage Value Formula Calculator Excel Template

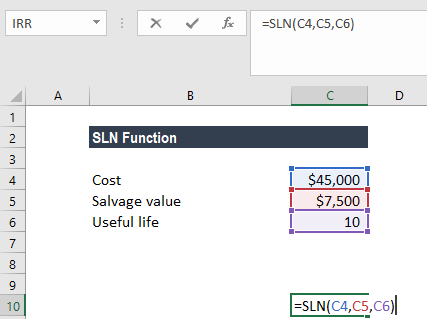

Sln Function Excel Formula For Straight Line Depreciation Examples

Accumulated Depreciation Formula Calculator With Excel Template